Tricon Residential Homes A Thorough Exploration of Their Model, Innovations and Impacts

In the evolving landscape of residential rental housing, Tricon Residential has emerged as a prominent player in North America. Specializing in both single-family and multi-family rental homes, Tricon leverages technology, community design, and scalable operations to meet high tenant expectations. In this article, we will dive deep into the Tricon Residential homes model, what sets it apart, benefits and challenges, real-world examples, technology integrations, use cases, and FAQs to help you fully understand this brand and its relevance in the modern housing market.

Overview and Background of Tricon Residential

Origins, Mission, and Business Focus

Tricon Residential (formerly Tricon Capital) is a Canadian real estate company headquartered in Toronto. Since its founding in 1988, Tricon has transformed from a smaller real estate entity into one of the major owners and operators of rental housing in North America.

The company’s mission centers on providing high-quality rental housing to middle-market tenants, bridging a gap between affordable housing and luxury rentals. Tricon operates with a philosophy of scale, consistency, and resident-centric management. It aims to deliver rental homes that feel like “living, not leasing” through service, modern amenities, and efficient operations.

Portfolio Strength, Scale, and Recent Developments

Tricon owns and operates large portfolios of single-family rental homes across U.S. Sun Belt markets, as well as multi-family rental units in Canada. Over time, its portfolio has grown to tens of thousands of properties.

A major recent development is that in May 2024, Blackstone Real Estate completed the privatization of Tricon Residential, acquiring all outstanding shares in a transaction valued at approximately US $3.5 billion. This change indicates the strength of confidence in Tricon’s model and the future potential of its pipeline across both single-family and multi-family housing.

Tricon continues to expand its development pipelines: Blackstone and Tricon plan over US $1 billion in capital allocation toward improving existing U.S. single-family homes, and another US $2.5 billion toward new apartments in Canada.

Core Characteristics of Tricon Residential Homes

Single-Family Rental Model vs. Multi-Family Rental

Tricon’s single-family rental (SFR) model involves acquiring or building detached houses in suburban and suburban-adjacent areas, and leasing them to families or individuals. These homes are intended to provide tenants with the feel of a standalone home-yard, privacy, garage, while being professionally managed at scale.

In parallel, Tricon maintains multi-family rental properties in urban centers (especially in Canada, e.g. in Toronto) to serve higher-density housing needs. This diversification enables Tricon to balance risk and tap into growth in both suburban and urban rental categories.

Resident Experience and Service Orientation

A defining feature of Tricon Residential homes is the emphasis on resident experience. The company adopts standardized property management practices, proactive maintenance, and responsive service to foster tenant satisfaction. Their operational systems are designed to deliver a consistent experience across many properties, with metrics and feedback loops to drive continual improvement.

Tricon also selects properties and neighborhoods strategically-considering school districts, access to amenities, commuting distances, and community appeal-to ensure that living in a Tricon home remains attractive over the long term.

Technological Innovations and Operational Efficiency

Smart Home Features and Automation

To stay competitive and meet rising tenant expectations, Tricon incorporates smart home technologies in many of its homes. These systems might include programmable thermostats, smart locks, remote water leak detection, energy monitoring, and automated alerts. These features improve comfort, safety, and reduce unnecessary utility waste.

Such integrations also allow Tricon’s operations teams to monitor home systems remotely and preempt issues-improving service speed and reducing emergency repair costs.

Data Analytics, Predictive Maintenance, and Operational Systems

Tricon leverages data and analytics to optimize property operations. Predictive maintenance models help identify when HVAC systems, plumbing, or roofs might fail before they become major problems. This proactive approach reduces downtime for tenants and lowers maintenance costs.

Further, Tricon employs centralized property management software, consolidating rent collection, lease renewals, inspections, and customer service into integrated platforms. This digitization supports scale, consistency, and transparency across its portfolio.

Technology in Tenant Engagement

Beyond home systems, Tricon offers tenant-facing portals and apps that streamline rental payments, maintenance requests, and communication. Digital onboarding processes, move-in checklists, and virtual leasing tours are increasingly common-especially in its newer developments.

This focus on technology-driven convenience aligns with the expectations of modern renters and strengthens the attractiveness and retention of Tricon homes.

Real-World Examples and Case Studies

Here are several notable projects or developments by Tricon that illustrate their model, scale, and innovations:

1. Tricon Peek Road, Katy, Texas

Tricon Peek Road is a build-to-rent community in Katy, Texas, spanning 22 acres. The community includes 175 detached rental homes (future target) with floor plans of 1,464 to 2,017 square feet, offering three- and four-bedroom layouts.

Homes are equipped with modern features like smart home technology, stainless steel appliances, fenced backyards, and two-car garages. Shared amenities include a pool, playground, dog park, and barbecue area, fostering community engagement.

Peek Road illustrates Tricon’s commitment to providing a suburban single-family experience with professional management, targeting renters who prefer a standalone house without the burden of homeownership.

2. Tricon Veranda and Tricon Willow Creek

Also in the Houston region, Tricon developed Tricon Veranda in Richmond and Tricon Willow Creek in Tomball. These offer similar build-to-rent detached housing under professional management, appealing to families seeking quality rentals in suburban settings.

These communities rely on similar design principles-neighborhood layout, green space, and amenities-to enhance quality of life, while streamlining operations from the back-end to achieve scale and lower per-unit costs.

3. Multi-family Projects in Toronto

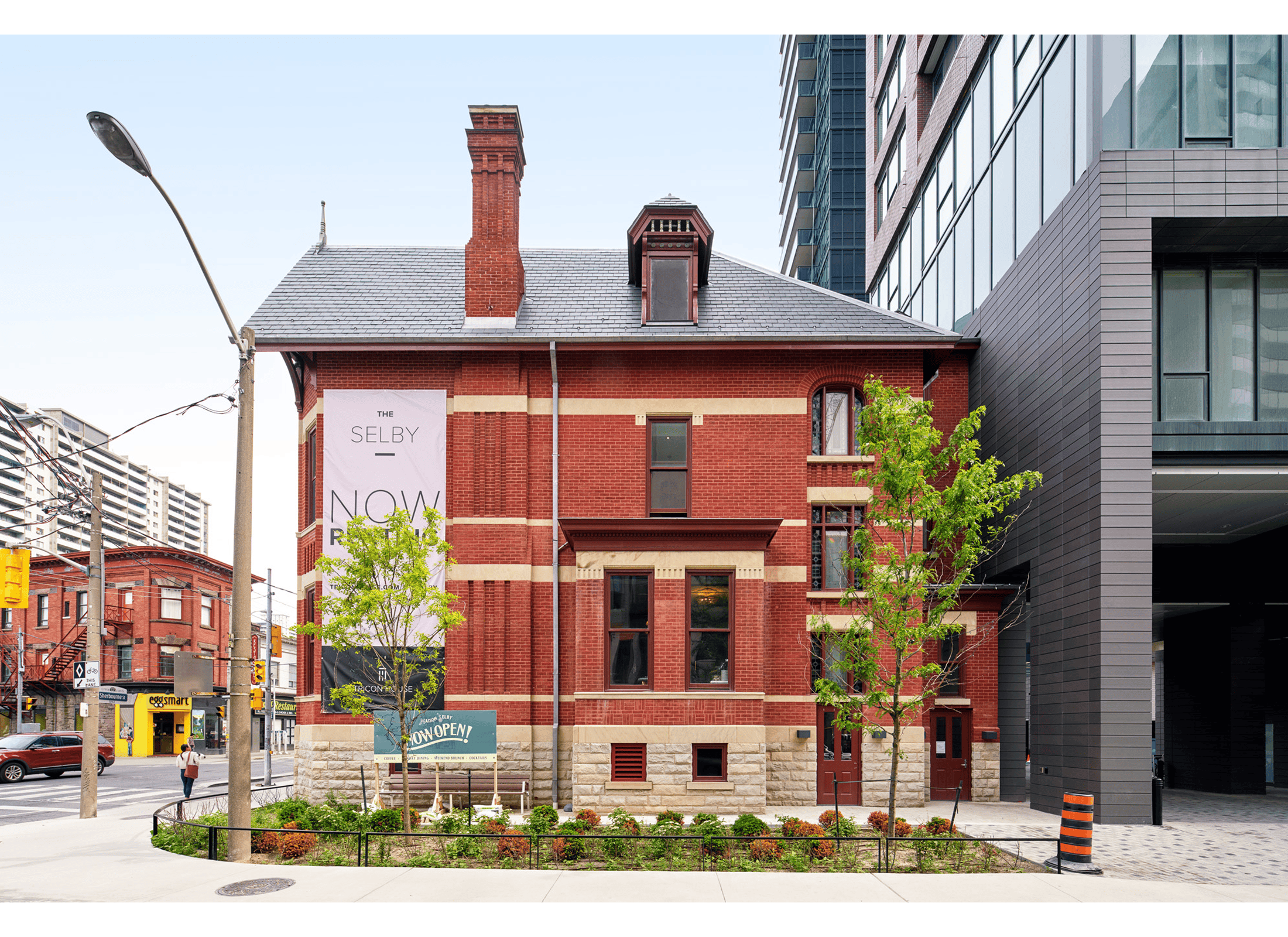

In Canada, Tricon has invested heavily in multi-family residential developments in the Greater Toronto Area (GTA). They actively develop new apartment buildings, such as The Selby and The Taylor, which combine rental units and integrated commercial or retail elements.

These projects allow Tricon to tap into urban demand for rentals in dense markets where detached single-family homes are less feasible. The approach blends high-density living with professional property management and amenities.

4. The Selby, Toronto

The Selby is a high-rise rental project in Toronto developed under the Tricon umbrella. It exemplifies how Tricon adapts to metropolitan contexts-offering units in urban centers rather than just suburbs.

The project pairs design aesthetics, amenities, and location advantages to appeal to renters who prioritize proximity to transit, employment, and cultural infrastructure.

Advantages and Benefits of Tricon Residential Homes

Scalability and Economies of Operation

One key benefit is scale. By owning or managing many homes in multiple markets, Tricon can negotiate bulk contracts for maintenance, materials, and services. This economy of scale reduces per-unit costs and allows for more competitive rents or higher margin retention.

Centralized systems and standard protocols permit consistency and quality control across hundreds or thousands of units, which smaller landlords may find difficult to maintain.

Predictable Cash Flow and Risk Diversification

Rental housing, especially when diversified across many geographies and housing types, provides relatively stable cash flow. While real estate markets fluctuate, demand for rentals remains steady, especially in growth regions or among populations that prefer flexibility over ownership.

By balancing single-family and multi-family portfolios across different markets, Tricon diversifies exposure to local economic fluctuations. Should one regional market soften, others may remain strong.

Enhanced Tenant Satisfaction and Retention

Through technology, thoughtful design, and professional management, Tricon aims to deliver a high-quality rental experience. Happy tenants are more likely to renew leases, reducing vacancy and turnover costs. The incorporation of smart home features, community amenities, and responsive service help achieve this.

Meeting Market Demand for Renters Tricon Residential Homes

In many markets, affordability and barriers to buying have increased. Many households prefer renting single-family homes over high-density apartments. Tricon’s business model meets this demand. Communities like Peek Road target tenants priced out of home-buying but desiring a house-like environment with reliability, amenities, and lower entry risk.

Innovation & Future Buffering

By investing in tech, data, and modern operations, Tricon is better positioned to adapt to future shifts-whether that’s in energy efficiency standards, smart home expectations, or rental market dynamics. The backing of a major investor like Blackstone provides capital to support upgrades and resilience.

Use Cases and Real-World Value

Use Case: Stable Suburban Living Without Homeownership Burdens

Families or individuals who want the privacy, yard, and space of a house but cannot or do not want to purchase one benefit from Tricon’s single-family rental model. They gain the lifestyle of a home-without worrying about major maintenance, property taxes, or market risk.

Use Case: Institutional Investors Seeking Real Estate Exposure

Institutional or large private investors looking for real estate exposure with predictable returns can invest in or partner with Tricon. The scale, diversification, and professional operations lower risk relative to fragmented small-scale property investments.

Use Case: Urban Rental Housing in High-Demand Cities

In dense urban centers where detached homes are scarce, Tricon’s multi-family projects deliver professionally managed rental units with modern amenities. This meets demand from professionals, young families, or empty-nesters seeking convenience and community.

Use Case: Innovation and Testing Ground for Smart Home Solutions

Tricon’s large portfolio is also a real-world lab for deploying energy-saving technologies, smart sensors, automation, and predictive analytics. If a solution proves viable at scale in Tricon homes, it may become mainstream in the residential rental sector.

Problem Solved: Quality, Predictability, and Management Consistency

One of the biggest challenges in the rental market is inconsistency-differences in landlord behavior, maintenance quality, or response times. Tricon addresses this by standardizing operations, enforcing quality protocols, and offering transparent service across many properties.

Another challenge is capital risk for renters. Homeownership requires down payments, mortgages, and maintenance. By contrast, Tricon’s model enables renters to enjoy home-like quality without that capital burden.

Challenges, Risks, and Considerations

No model is without risks. Here are some key challenges:

-

Market Sensitivity: Real estate markets can decline. While diversified, Tricon is not immune to broader macroeconomic headwinds.

-

Debt and Capital Structure: Large-scale property portfolios often require substantial leverage. Mismanagement or interest rate rises could strain finances.

-

Tenant Default Risk: In single-family models, missed rent on a house is more impactful. Efficient systems and screening are necessary.

-

Maintenance Complexity: Detached homes have more perimeter (roofs, yards, exteriors) to maintain, compared to apartment units.

-

Regulatory & Tax Environments: Changes in rental laws, pro-tenant regulations, or property taxes may affect profitability.

However, Tricon’s scale, data-driven operations, and backing make it better equipped to manage these risks than smaller landlords.

Why Tricon Residential Homes Are Influential in Rental Housing

Tricon’s approach demonstrates a path toward modernizing rental housing. Rather than viewing rentals as stop-gaps or low-quality options, Tricon positions its homes as high-standard, fully managed, and technology-enabled alternatives.

By blending suburban living with professional management and smart operations, Tricon shapes tenant expectations and raises the bar for what renters can expect. Its dual presence in single-family and multi-family sectors allows it to capture wide segments of the housing demand.

Moreover, the acquisition by Blackstone reflects confidence in the long-term viability of its model and the growth potential for professionally managed rentals. The capital infusion may fuel expansion, upgrades, and deeper innovations.

Frequently Asked Questions

Q1. What is “build-to-rent” and how does it relate to Tricon?

“Build-to-rent” refers to housing communities designed and constructed specifically for rental, rather than for sale. Tricon’s Peek Road community is a prime example of this strategy: homes are built, maintained, and managed by Tricon for long-term rental occupancy.

Q2. How does Tricon ensure consistent service across many different homes?

Tricon uses standardized operations systems, predictive maintenance analytics, centralized property management software, and a data-driven approach. This allows them to monitor, benchmark, and enforce quality across all properties.

Q3. What changed after the Blackstone acquisition of Tricon?

With Blackstone’s acquisition in 2024, Tricon gains greater access to capital and strategic support. Plans include increased investment in new apartments in Canada and improvements to existing single-family homes in the U.S. The acquisition also marks a shift toward privatization and perhaps long-term expansion beyond publicly traded constraints.